If you’ve experienced significant damage to your roof from hail, wind, storms, or natural disasters, you’ll be filing a claim with your insurance company. Dealing with the roof damage is stressful enough — adding the insurance claim process on top of it can cause anyone undue anxiety. Oaks Construction is here to help alleviate some of that burden with this guide to navigating your roofing insurance claim.

Call 585.247.6257 with your roofing claim questions!

After the Storm

Your first step after a major storm is to look for obvious damage to your roof. You may be able to see broken or missing shingles, hail damage, or leaks. These problems may or may not be visible from the ground. We do not advise that you get up on your roof for safety reasons. Photograph your roof and any areas of damage that you can see.

If you notice leaks, missing shingles, dents, or other damage, you’ll need a professional roofing contractor to assess the roof in a timely manner. Your home insurance may have a time limit on how long after the damage you have to submit your claim, so make that call as soon as possible.

Roof Inspection

Our Oaks Construction roofers know exactly what to look for when they inspect your roof. As experienced contractors, we know what your insurance company will require as far as documentation, and we’ll make sure we have everything you need. We’ll be your advocate throughout the claim process.

Get An Estimate

Once we’ve identified any damage to your roof, we’ll provide you with a free estimate for our services. We’ll include pictures of the damaged areas, a thorough explanation of what needs repair, and the estimated cost.

Pro Tip:

If the estimated cost is less than your insurance deductible, there’s no need to file a claim. You will foot the entire bill and the claim, even though it didn’t pay anything, has the potential to raise your premium by putting you in a higher risk category.

Check Your Policy

Before going any further, it’s important to pull out your homeowners policy and get familiar with your coverage. Roofs are generally covered in one of two ways, Actual Cash Value (ACV) or Replacement Cost Value (RCV).

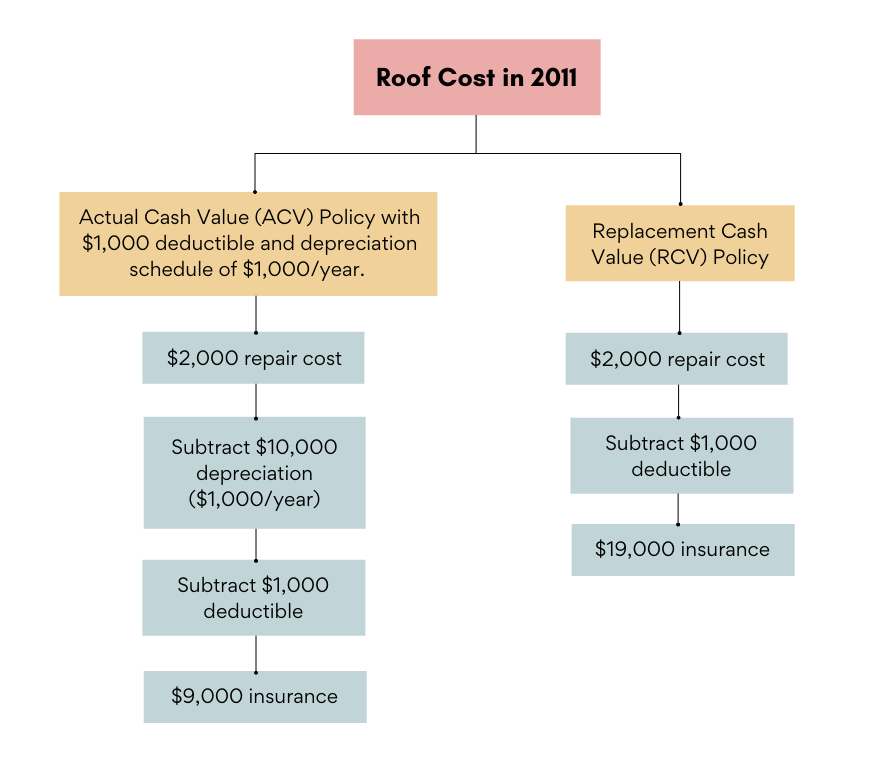

If your coverage is ACV, the insurance company will pay the cash value of your roof at the time of your claim. This is determined by subtracting your deductible and depreciation costs (based on the age of your roof) from your roof value. The older your roof, the higher the depreciation, the less covered by your policy.

RCV policies will pay the cost value of your roof at the time of your covered loss. This is determined by taking the replacement cost and subtracting your deductible. Depreciation is not a factor in RCV coverage. Below is an example of insurance payout for ACV vs. RCV policies.

A Word on Warranties

Manufacturer and workmanship warranties will probably not come into play if your roof is damaged by a major weather event. Manufacturer warranties cover materials and aren’t likely to be applicable in cases of storm damage. A workmanship warranty would only kick in if it can be proven that the damage is related to faulty work in addition to the storm.

Experienced Contractors

When dealing with a roofing job, you should always choose a contractor who is licensed, insured, reputable, knowledgeable, and experienced. Look your contractor up online to find out about them and read reviews. Oaks Construction, for example, is listed on the BBB, Angi, Google, Facebook, and other online review websites.

At Oaks, we’re also experienced in helping our customers deal with insurance claims. We’re happy to assist you through every step of your insurance claim process.

File Your Claim

Each insurance company has its own process for filing a claim. Most companies have simple online claim filing processes. Your insurer will assign an insurance adjuster who will inspect your roof and any other property damage related to the storm. The adjuster will report their observations back to the insurance company.

Next, the insurance company will determine how much you should be paid for your home repairs. This step tends to take a significant amount of time. This is the biggest reason for delays in getting your repairs done.

While they are reviewing your claim, the insurance company may ask for more information or documentation from the roofing company. Because we’ve anticipated this, our Oaks staff will have all of the necessary information promptly available. A quick response to the insurance company will keep your claim moving through the system.

Finalizing Your Claim

Once your claim is finalized and processed, your insurance company will send a check to you for the amount they have determined you are owed. The check is intended to cover the cost of repair or replacement of the damaged roof. In cases of ACV insurance, you may receive payment in two parts, one before work starts and one after work is complete. When the job is done, we’ll walk you through an inspection of our work and send the required paperwork to your insurance company so they will release the held depreciation payout.

This is the end of your insurance company’s involvement.

Your New Roof

After the repair or replacement of your roof, we’ll turn over all applicable warranties for materials and workmanship to you.

All that’s left is for you to leave Oaks Construction a 5-star review! Give us a call at 585.247.6257 (make click to call) with your roofing claim questions!