New York Incentives for Solar Roofing

You may be considering solar roofing to reduce your carbon footprint or lower your energy bills. That’s great! Did you know that there are even more incentives offered to New York residents and business owners? At Oaks Construction, we’ve put together a list of the incentives you should be aware of when considering solar. And when you’re ready for that solar roof? Call 585.247.6257.

Megawatt Block Incentive

The Megawatt Block program provides subsidies for commercial and residential rooftop solar energy systems. The amount of your subsidy is dependent upon the size of your solar system and how much solar energy is being produced in your area. The incentive is a discount delivered in a “dollar per watt” format, with a cap of $1/watt. Incentives will decrease — and eventually disappear — as more people go solar and the predetermined blocks have filled up.

No need to worry about a painful application process. This subsidy is applied to the total price of your solar roofing system. Ask us for more information!

Catch Some Sun with Oaks Construction!

Net Metering

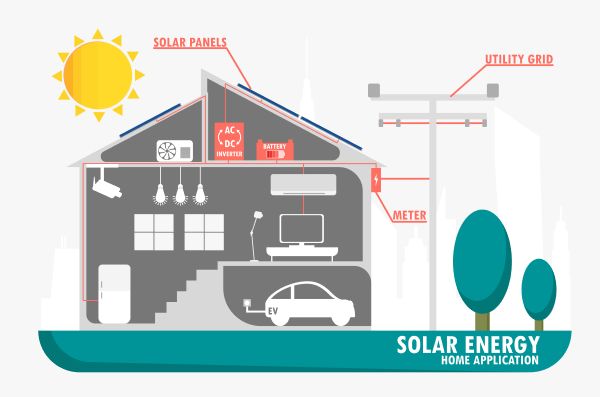

Your renewable energy system can be connected to the grid or work independently. Only grid-connected systems are eligible for net metering.

When you’re connected to the utility grid, any time your home is using more electricity than your solar roofing is producing, your energy needs are supplemented by the grid. However, if your home is using less energy than you’re producing, the excess electricity is transported to the grid and you receive a credit. This is referred to as “the meter spinning backward” because it is recorded as negative use.

At the end of your billing cycle, your energy use from the grid and negative use are reconciled. If you have surplus credits, they will be carried forward to your next billing cycle. You may accumulate a bank of credits to be used in the months your system produces less electricity.

New York State Solar Equipment Tax Credit

New York State offers a tax credit to those who purchase solar energy equipment for the purpose of heating, cooling, hot water, or electricity for residential use. The credit is 25% of your solar energy equipment, up to $5,000. Complete the IT-255 claim form to receive your tax credit.

Federal Solar Tax Credit

In addition to the New York State incentives, there is also a federal solar tax credit. The Investment Tax Credit (ITC) allows you to deduct 26% of the cost of installing a solar energy roof from your federal taxes. There is no cap, and this credit applies to both residential and commercial properties. Just use Form 5695 for residential energy credits. The amount of this credit will decrease at the beginning of 2023, so call 585.247.6257 to get that solar roof started!

Save the Earth — and your wallet — now! Catch Some Sun with Oaks!